Releases Setup: Depreciation, Prepayments & Deferred Revenue

Learn how to use the Releases feature in Light to automate revenue and expense recognition with flexible accrual templates for deferred revenue, prepaid expenses, and depreciation.

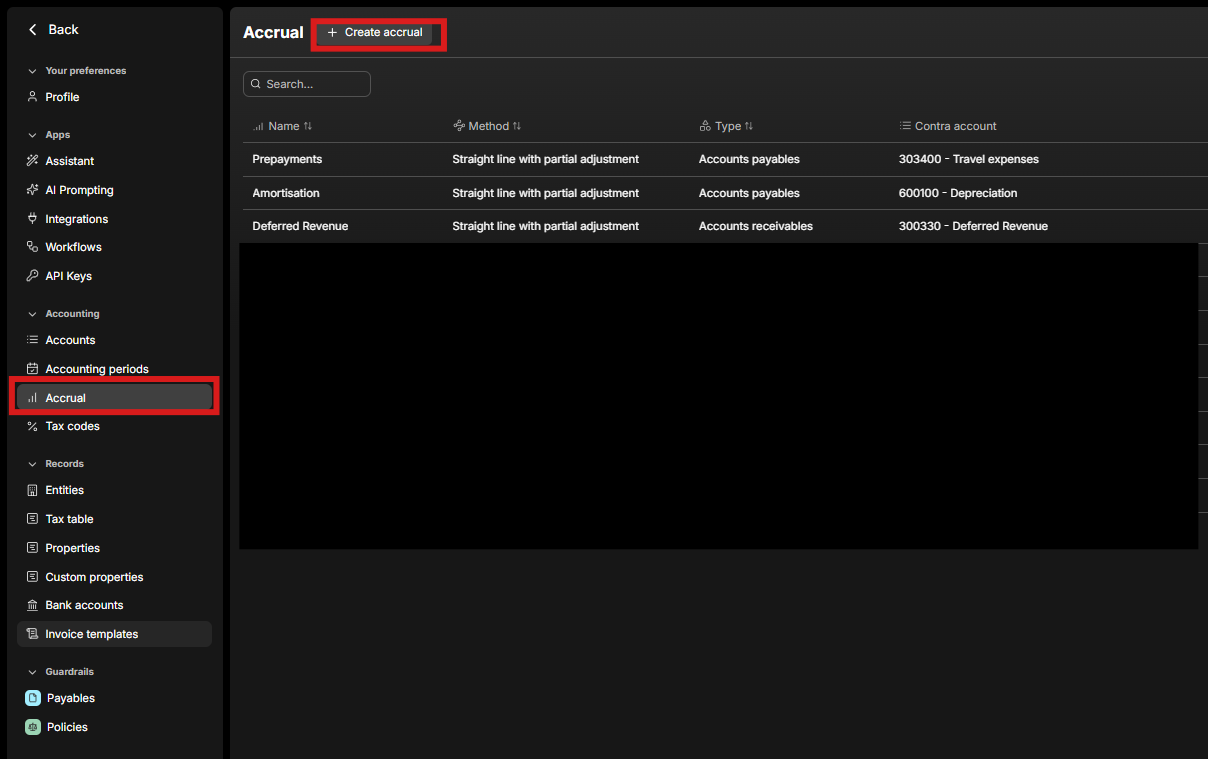

The Accruals section in Light allows you to automate diverse release schedules.

💡Example Use Cases

-

Deferred Revenue – spread recognition of upfront customer payments across contract duration.

-

Prepaid Expenses – allocate costs of annual software licenses over 12 months.

-

Depreciation – automate monthly depreciation of fixed assets.

Step 1 – Navigate to Release

Go to Settings → Accruals.

Step 2 – Create a New Release Template

-

Click Create Release.

-

Fill in the required fields:

-

Name – e.g. Deferred Revenue

-

Method – Straight-line or Increasing-base

-

Type – e.g. Accounts receivable or Accounts payable

-

Contra Account – e.g. Deferred revenue

-

-

(Optional) Configure additional fields:

-

Initial amount %

-

Residual amount %

-

Default duration (months)

-

Accumulate past amounts (checkbox)

-

Step 3 – Apply Release Templates

-

After saving, your release templates will be available as a column in line items for:

-

Sales invoices (type: Accounts receivable)

-

Bills (type: Accounts payable)

-

Other documents depending on setup

-

-

To apply:

-

Click on the Release column in a line item.

-

Select the accrual template.

-

Choose the period over which you want the expense or revenue accrued.

-